Head Start Policy Update: Housing Adjustment

Fantastic news! Thanks to a change from the Office of Head Start (OHS) in its Performance Standards, you can now use excessive housing costs to adjust income for eligibility.

In response, GoEngage has developed a feature that calculates the adjusted income, using excessive housing costs. A colorful tag will provide a visual indicator of income eligibility.

The feature will launch with GoEngage Version 21.5 on Monday, December 9, 2024.

The change in the Performance Standards

OHS's change recognizes that families in high-cost regions may allocate a large percentage of their income toward housing, thus impacting their ability to afford other essential needs. (Citation: HSPPS §1305.2 and §1302.12 Update on ECLKC)

Summary: There is a new definition of what qualifies as income. (HSPPS excerpt below)

Definition of Income

The updated definition of income seeks to provide clarity and make it less burdensome to implement. “Income” means gross income and includes only:

Wages

Business income

Unemployment compensation

Pension or annuity payments

Gifts exceeding the threshold for taxable income

Military income (excluding special pay for a member subject to hostile fire or imminent danger or any basic allowance for housing)

Public assistance and refundable tax credits are not considered income.

Summary: If a family spends more than 30% of their total gross income on housing, you can subtract from their total income the amount spent on housing that exceeds 30%. This lowers the bar for a family to qualify for Head Start / Early Head Start. (HSPPS excerpt below)

Adjustment for Excessive Housing Costs for Eligibility Determination

The high cost of living in some regions means that families earning slightly above poverty wages spend a significant portion of their income on housing. This situation has led to concerns that the previous eligibility criteria might not fairly reflect families’ financial needs. The updated Performance Standards allow programs to adjust for excessive housing costs when making eligibility determinations.

Housing costs are a family’s total annual applicable housing expenses, which may include:

Rent or mortgage payments

Homeowner's or renter's insurance

Utilities (e.g., electricity, gas, water, sewer, trash)

Interest and taxes related to housing

Programs may use bills, bank statements, and other relevant documentation to calculate a family’s housing costs to determine eligibility. If a family spends more than 30% of their total gross income on housing costs, their total gross income can be reduced by the amount spent on housing costs that exceed 30% of their income.

The updates in GoEngage

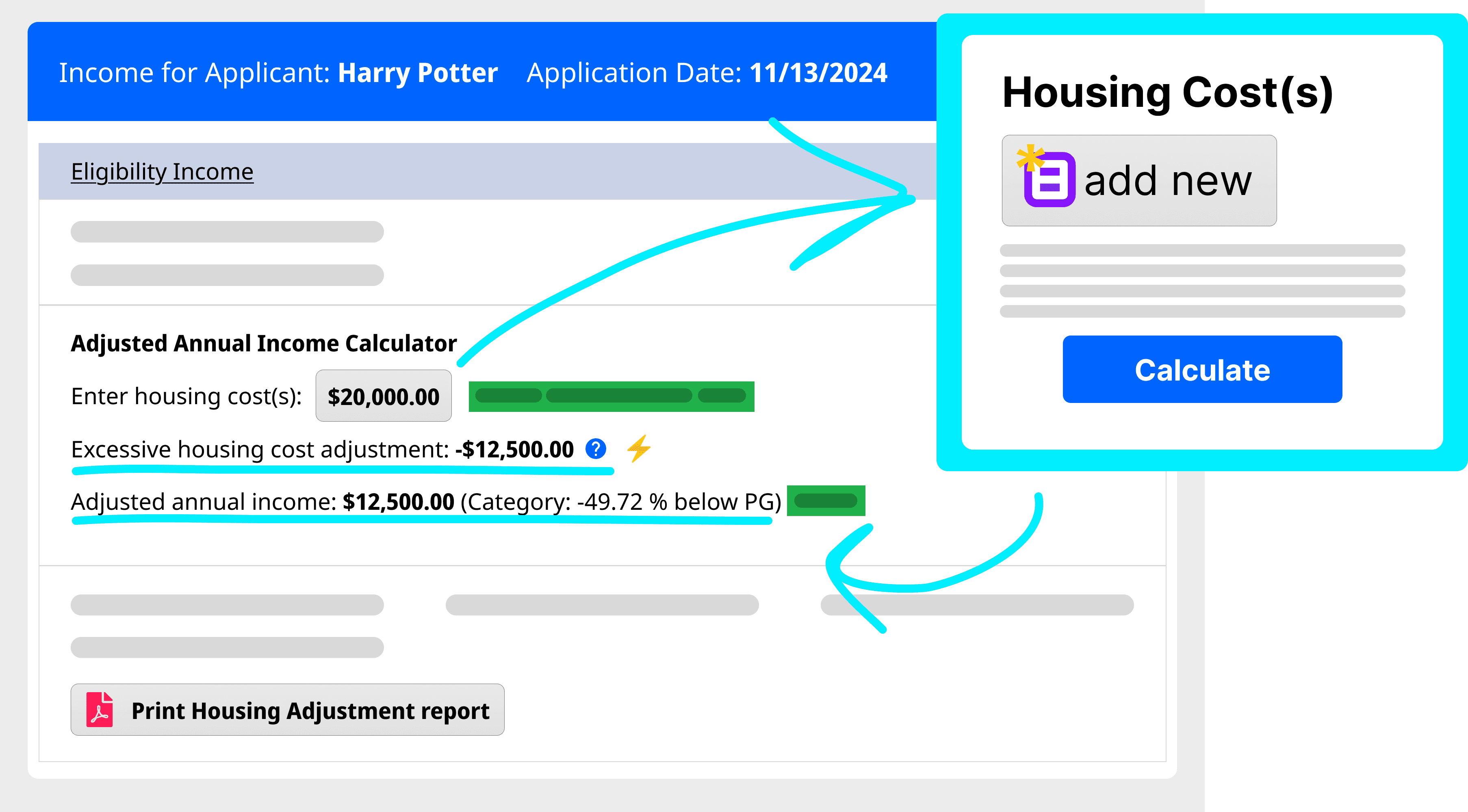

The housing calculation will appear in the Income section of the Application Form! A few notable features:

⚡Housing Cost Calculator for Eligibility Adjustment

GoEngage will add data entry fields for tracking essential housing costs, including homeowner's/renter's insurance, interest, rent/mortgage payment, taxes, and utilities.

🧮 Automatic Adjusted Income Calculation

GoEngage will automatically calculate the excessive housing cost adjustment according to OHS's formula, and then display the final adjusted eligibility income.

🚩 Colorful Tags

Colorful tags will help you quickly identify the family's eligibility category.

📎 Document Upload for Supporting Evidence

To streamline the verification process, GoEngage will show a document upload button for you to upload evidence provided by families to support excessive housing cost claims.

🖨️ Print Report

GoEngage will print a Family Income sheet with the Housing Cost Adjustment Calculation included.

Signing off for now

The new OHS standards are a pivotal step toward ensuring Head Start agencies remain accessible to families facing financial challenges. With GoEngage’s next update, Head Start agencies can easily implement these changes, keeping the ERSEA process streamlined.

Thank you for being a part of the GoEngage community! We're glad you're here, and we will continue to work quickly to adapt our solution to address immediate real-world challenges.

Stacy Lewis: Senior Director of Business Development at Cleverex Systems

Stacy Lewis is the Senior Director of Business Development at Cleverex Systems, the creator of GoEngage. A trusted leader in the Head Start software space since 2001, Stacy brings over 24 years of experience, including key roles at ChildPlus, KinderSystems (COPA and California subsidy products), and Learning Genie, before joining GoEngage.

Throughout her career, Stacy has helped countless agencies optimize operations, enhance family engagement, and achieve compliance with federal and state standards. Her extensive industry knowledge and commitment to innovation continue to drive transformative solutions that empower Head Start programs to better serve children and families.